We make benefits easier.

Whether it is helping to manage the components of a comprehensive benefits plan or structuring a complex self-funded and population risk management platform, benecurv brings experience, competence and sophistication.

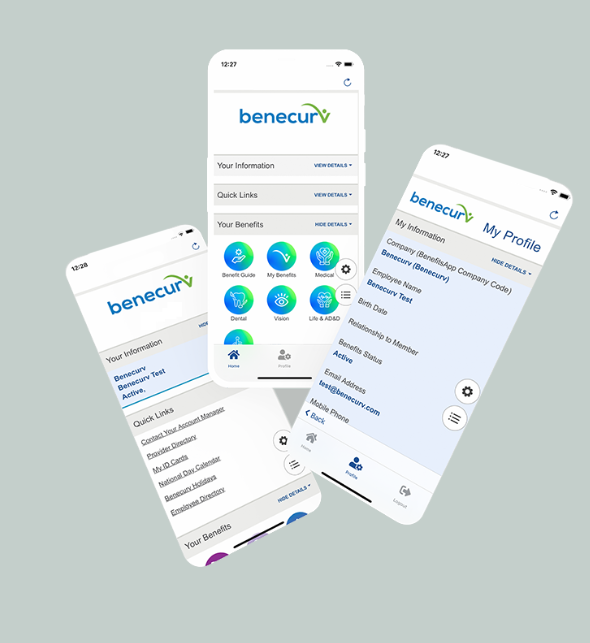

Through our mobile insurtech platform, we enhance traditional access, information and account support for your employees and their families.

The benecurv team has the expertise you need to help add value to your benefits and your business.

Ready to get started?

Schedule 15 minutes of meeting...

We are changing the game in the customer support world. Those that are running an older playbook will be left behind.

Employers come to benecurv when they need experienced guidance around benefits design. They want deep advocacy for their employees and their families. They want to be sure that any State & Federal Compliance regulations are addressed proactively.

While the exercise of “shopping” benefits still occurs, the way those benefits are designed, valued, understood and supported has changed. Employees and their families want information quickly and they want problems solved just as fast.

Enter benecurv.

COMPREHENSIVE SERVICES

A Few of Our Offerings

Mobile Benefits Technology:

Mobile Benefits Technology:

At benecurv, there is a lot of time and effort procuring the best product combinations to provide security for your employees and their dependents.

We provide our clients with an easy-to-use mobile app, which simplifies the understanding of the employee benefits offerings and strengthens communication between the employee, dependents, our account management and the resources they need to navigate their benefits.

Easy – Simple – Fast!

Virtual Primary Care Clinic:

Virtual Primary Care Clinic:

“Face time” doctor visits with dedicated primary care physicians (PCPs) allow your employees to save time and money while receiving high quality, convenient care.

This unique program offers unlimited video & phone visits with a dedicated primary care physician for $10/adult/month, providing quality care quickly and remotely to members.

- Members have text message access to a dedicated PCP

- Members can request care and prescription refills by app or online

- $0 co-pays with $0 deductibles

- Dedicated PCP’s can treat over 1500 conditions, provide specialist referrals and order lab and imaging tests

Employee and Dependent Advocacy:

Employee and Dependent Advocacy:

Get help with a confusing bill, find a nearby provider, or just simply ask a quick question via phone, email, text or mobile app.

RxCare Assistance / medical cost transparency – We ensure you never overpay for medicine by researching all options and costs.

Open Enrollment Support – Navigating the healthcare system is tricky, let alone understanding your benefits. We provide your employees with complete support with selecting a plan that works best for them.

We make the use of your employer-sponsored benefits easy and stress-free by using clear and simple language.

Online Benefits & HR Administration:

Employers and the HR team have a lot on their plate every day. To help take some of those tasks off their to-do list, we onboard our clients onto our online employee benefits portal housing all important benefit documentation. Through this portal, employees can logon and make their plan elections and view their benefits, which eliminates the need for paper applications and frees up the employers time to focus on business. Whether it is open enrollment or there is a new hire, 1-on-1 sessions are also available with trained benefit counselors to communicate coverage and costs of each plan to assist the employees and new hires with their benefit decisions.

Through our partnerships with various benefits admin platforms, we are able to provide many key services, such as:

– Beneficiary Tracking

– Broadcast Emails to HR

– Carrier Integration & Reporting

– Company & HR Imports

– Compliance Documentation

– Customizable Branding

– Data Import/Export

– Enrollment Change Reporting

– HIPPA Compliant

– HR Management

– HR Resource Library

– HSA/FSA Administration

– Integrated COBRA Administration

– Medical & Ancillary Plan Administration

– Online Benefits Enrollment

– Payroll Integration & Reporting

– Self-Service Portal

– 1095-C & 1094-C Reporting

HR Compliance Review:

HR Compliance Review:

Are you 100% sure you are in compliance? The laws behind the ACA, ERISA, HIPAA, FMLA and Medicare are ever changing. No matter what size your company is, let our team provide a complimentary review of your employee benefits to make sure you are not exposed to any costly fines or lawsuits due to non-compliance.

Predictive Modeling – Data Analytics & Benchmarking:

Predictive Modeling – Data Analytics & Benchmarking:

Through our robust data tools, we deliver cost-saving insights. We simplify big data such as HRA’s, biometrics, medical and pharmacy claims, lab info, etc. and support strategies that achieve results. There is a difference between information, findings, and action upon those findings. Our tools turn data into those actionable protocols to support a healthier population and a more financially predictable health plan.

Large Group Detailed Plan Management:

Large Group Detailed Plan Management:

Managing a large group health plan has many similarities to managing a business. You do not just have an idea and then “wing it.” You have a plan, you have a deliverable, there are assumptions and projections, and you manage them and pivot as needed to ensure success. Managing a health plan is similar. You have a strategy of cost control and predictability, but that in and of itself does not ensure success. You need a partner that understands the inner workings of the plan, all the moving parts, and one that can report to you financially on not only the health plan, but the health of the population the plan is insuring. That requires the right tools, the right oversight, and the right experience. Let us show you our results so you can stop operating your health plan from the rear-view mirror.

ICHRA & QSEHRA:

ICHRA & QSEHRA:

Predictable Solutions that may save time & money…

ICHRA (Individual Coverage HRA) WORKS FOR SMALL AND MID-SIZE BUSINESSES

1. Available to any business not offering group health insurance

2. Flexible design options based on employee classes

3. Employees must have individual health insurance to participate

4. Employees may opt-out of plan

You may add Health and Dependent Care Flexible Spending Accounts to maximize tax benefits for the employee and employer

QSEHRA (Qualified Small Employer HRA)

1. Available to businesses with fewer than 50 employees not offering group health insurance

2. Employees must have individual health insurance to participate

You may add a Dependent Care Flexible Spending Account to maximize tax benefits for the employee and employer

A professional employer organization (PEO) is an outsourcing firm that provides services to small and medium-sized businesses. A PEO may offer services to include resource consulting, safety and risk mitigation services, payroll processing, employer payroll tax filing, workers’ compensation insurance, health benefits, employers’ practice and liability insurance (EPLI), retirement vehicles (401(k)), regulatory compliance assistance, workforce management technology, and training and development. The Employer enters into a contractual co-employment agreement with the PEO. In this co-employment relationship, the PEO becomes the employer of record for tax purposes through filing payroll taxes under its own tax identification number(s). As the legal employer, the PEO is responsible for withholding proper taxes, paying unemployment insurance taxes and providing workers’ compensation coverage.

A professional employer organization (PEO) is an outsourcing firm that provides services to small and medium-sized businesses. A PEO may offer services to include resource consulting, safety and risk mitigation services, payroll processing, employer payroll tax filing, workers’ compensation insurance, health benefits, employers’ practice and liability insurance (EPLI), retirement vehicles (401(k)), regulatory compliance assistance, workforce management technology, and training and development. The Employer enters into a contractual co-employment agreement with the PEO. In this co-employment relationship, the PEO becomes the employer of record for tax purposes through filing payroll taxes under its own tax identification number(s). As the legal employer, the PEO is responsible for withholding proper taxes, paying unemployment insurance taxes and providing workers’ compensation coverage.

benecurv brings in depth experience around assessing and implementation as well as evaluation and unbundling when the employer has increased in size and has a compelling financial reason to bring these services in-house. Let us help you evaluate the value of this potential employee benefits strategy.

COMPETENCE

With a well-defined process built over years of experience, we work alongside employers and focus on the following areas within the employer-sponsored offerings:

- Identify current risk within the plan or products

- Understand risk and ways to reduce it

- Manage current risk within the population and benefits compliance

- Mitigate future risk by identifying eventual or avoidable categories and implementing the proper risk transfer strategies

This comprehensive methodology, fortified by years of experience, allows us to optimize employer-sponsored offerings for maximum efficiency and effectiveness.

EXPERIENCE

With over 30+ years of experience in the insurance & employee benefits arena, our leadership team has held roles with insurance carriers, wellness & population health organizations, claims-paying third-party administrators, enrollment technology platforms and has built and executed successful full-service HR and employee benefits management organization. Regardless of employer size, we have the track record to support our deep analysis.Their cumulative expertise led to the successful establishment and execution of comprehensive, full-service HR and employee benefits management organizations.

SOPHISTICATION

We utilize robust technology starting with our CRM built on the Salesforce Platform – the #1 CRM in the market. Our in-depth knowledge of every moving part in benefits design, plan procurement and administration allows us to recommend the proper technology and connectivity to maximize the integration for HR and the overall benefits experience. Our deep understanding of predictive modeling, population health analytics and underwriting provide the transparency often missing in benefits plan management.

Access

On-demand access to full benefit guide information, contacts, forms, apps and resources.

Engagement

Connect on a mobile level with your employees. Enable them with interactive calendars, monthly news, company blogs, forms and more.

Communication

Use Push Messaging and in-app communications to convey timely and important information to employees.

Health&Wellness

Deliver easy access to wellness resources, telemedicine and cost-saving resources.

Install the benecurv app for free!

Register with Company Code: Demo to see a live demo.

Request a Demo

We are happy to schedule a walkthrough of our six-step process, our insurtech platform and review the employee/employer experience. Our goal is to demonstrate how benecurv will give HR back some of their valuable time.